Starting with free cash flows from operations, discuss how an analyst would measure free cash flows to common equity shareholders

Free cash flows from operations would be adjusted for capital expenditures, which would leave free cash flows for all debt and equity capital stakeholders. This amount would then be adjusted for financing activities, which would include debt cash flows, financial asset cash flows, and preferred stock cash flows.

You might also like to view...

Which of the following statements best represents when an organization can begin to focus on its discretionary or philanthropic responsibilities?

A. An organization should pursue discretionary responsibility even when it is not meeting its economic requirements. B. An organization should pursue discretionary responsibility after it meets its economic, legal, and ethical responsibilities. C. An organization should pursue discretionary responsibility as long as it is meeting its economic requirements. D. An organization should pursue discretionary responsibility above legal responsibility.

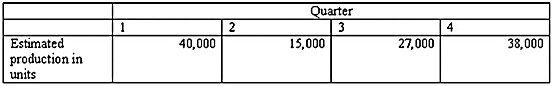

Morris Company makes one product, and it expects to incur a total of $600,000 in indirect (overhead) costs during the current year. Production of the product for the year is expected to be: Required:1) Calculate a predetermined overhead rate based on the number of units of product expected to be made during the current year.2) Assuming that direct materials and direct labor costs are $10 and $15, respectively, determine the total cost per unit using the overhead rate you calculated in part (1).

Required:1) Calculate a predetermined overhead rate based on the number of units of product expected to be made during the current year.2) Assuming that direct materials and direct labor costs are $10 and $15, respectively, determine the total cost per unit using the overhead rate you calculated in part (1).

What will be an ideal response?

Which of the following products, derived from a joint production process, has no sales value?

a. joint products. b. scrap. c. waste. d. by-products.

Which of the following guidelines should you follow during a presentation?

A) ?Communicate enthusiasm for the presentation. B) ?Maintain eye contact with only one person in the audience. C) ?Do not paraphrase the presentation visual. D) ?Do not handle questions from the audience during the presentation.