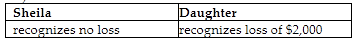

Sheila sells stock, which has a basis of $12,000, to her daughter for $7,000, the stock's fair market value. Subsequently, the daughter sells the stock to an unrelated party for $5,000. Which of the following is true for Sheila and her daughter?

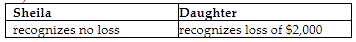

A)

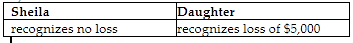

B)

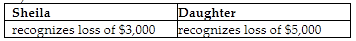

C)

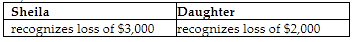

D)

A)

The $5,000 ($7,000 - $12,000) loss on Sheila's sale to Daughter is disallowed under the related party transaction rules. Her daughter's subsequent sale at a $2,000 loss, however, is recognized. The disallowed loss incurred by Sheila can only be used to reduce her daughter's subsequent gain, not loss.

You might also like to view...

Standards that reflect what is expected to occur are referred to as ______________________________

Fill in the blank(s) with correct word

To create an implied-in-fact contract, it must be established that a plaintiff provided a property or services gratuitously

Indicate whether the statement is true or false

The holder of preferred stock is entitled to a constant dividend ________

A) every period B) only when earnings are positive C) only when the stock price increases D) only when earnings are positive and only when the stock price increases

Mary, a sales representative for a small cleaning business, asks current customers for names of friends, customers and other businesses that might be interested in the company's cleaning services. Mary is relying on ____ to identify potential customers.

A. customer-initiated contacts B. impersonal referrals C. marketer-initiated contacts D. personal referrals