Table 14.1Monetary Aggregates of the U.S. Financial SystemItemAmountCash held by public$250 billionTransactions deposits$1,000 billionRequired reserves$150 billionExcess reserves$0 billionU.S. bonds held by public$1,000 billionAssume an original balance sheet: On the basis of the information in Table 14.1, the required reserve ratio is

A. 10.0 percent.

B. 15.0 percent.

C. 6.5 percent.

D. 20.0 percent.

Answer: B

You might also like to view...

Ricky is thinking about borrowing $10,000 from Fred. He promises Fred cash flows of $5000 for the next three years. If Fred's cost of capital is 10%, what is the Net Present Value of the investment for Fred?

a. -$126.55 b. $1,342.76 c. $2,434.26 d. -$1,322.31

Assuming no crowding-out, investment-accelerator, or multiplier effects, a $100 billion increase in government expenditures shifts aggregate demand

a. right by more than $100 billion. b. right by $100 billion. c. left by more than $100 billion. d. left by $100 billion.

The marginal revenue product of labor is:

a) The additional revenue a firm receives from hiring one more worker. b) Equal to the marginal physical product of labor times the wage rate. c) Equal to the price of the product times the wage rate. d) The additional output from hiring one more worker.

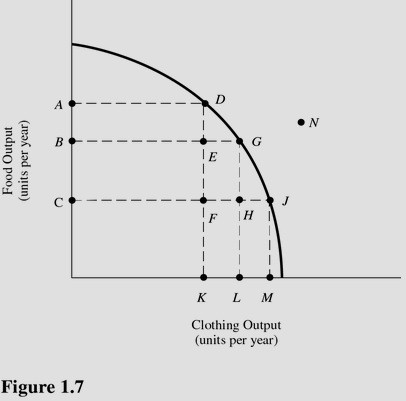

Refer to Figure 1.7. Which of the following points are considered to be inefficient?

Refer to Figure 1.7. Which of the following points are considered to be inefficient?

A. G. B. D, G, and J. C. E. D. D.