Which of the following could be a cause of consumption decreasing?

A. Real income increases.

B. Interest rates increase.

C. Wealth increases.

D. Expected future income increases.

B. Interest rates increase.

You might also like to view...

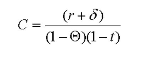

Assume that the user cost of capital (C) is simply

where r is the after tax rate of return, ? is the depreciation rate, ? is the corporate tax rate and,

r is the individual tax rate. Now assume further that the after-tax rate of return is 10 percent

and the economic depreciation rate is 2 percent. The firm faces corporate taxes of 35 percent

with an individual tax rate of 25 percent. Suppose that we now know that the present value of

depreciation allowances is 0.20. In addition, there is an investment tax credit of 0.10. What

effect does this new information have on the user cost of capital?

The impact lag facing the Fed is

A) the delay before open market operations are able to affect the monetary base. B) the delay before the Fed's announcement of a new policy has an impact on the decisions of the public. C) the time required for monetary policy changes to affect output, employment, and prices. D) the delay before the impact of a recession on output and prices becomes clear to the Fed.

What is the Law of One Price?

What is the difference between accounting profit and economic profit?

a. They are the same thing. b. They are only different if the accountant makes a mistake. c. Accounting profit is usually smaller than economic profits. d. Accounting profit makes no allowance for several implicit costs, including equity capital, while economic profit takes these costs into account.