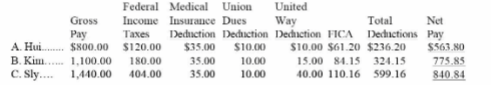

The payroll records of a company provided the following data for the current weekly pay period ended March 12.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $118,500 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Calculate the net pay for each employee.

You might also like to view...

A dummy independent variable is defined as one that is scaled with a categorical 0-versus-1 coding scheme

Indicate whether the statement is true or false

Which of the following is not included in the cost of quality?

a. Inspection costs b. Costs of handling customer complaints c. Rework costs d. Inventory ordering costs

In a leasehold estate, a tenant may move out of the property and sublease it to another party unless prohibited by the lease

Indicate whether the statement is true or false

What happens when prices are falling?

A. LIFO will result in higher net income and a lower inventory valuation than will FIFO. B. LIFO will result in higher net income and a higher inventory valuation than will FIFO. C. LIFO will result in lower net income and a lower inventory valuation than will FIFO. D. LIFO will result in lower net income and a higher inventory valuation than will FIFO.