A sales tax creates a deadweight loss because

A) there is some paper work opportunity cost of sellers paying the sales tax.

B) demand and supply both decrease.

C) less is produced and consumed.

D) citizens value government goods less than private goods.

E) the government spends the tax revenue it collects.

C

You might also like to view...

When 2,000 hamburgers per day are produced, the marginal social benefit is $1.50 and the marginal social cost is $1.00. And when 7,500 hamburgers per day are produced, the marginal social benefit is $1.00 and the marginal social cost is $1.50

The efficient production quantity of hamburgers is ________ a day. A) more than 7,500 B) 7,500 C) between 2,000 and 7,500 D) 2,000

When the value of loans begins to drop, the net worth of financial institutions falls causing them to cut back on lending in a process called

A) deleveraging. B) releveraging. C) capitulation. D) deflation.

When money is used to set the value of goods such as cars, VCRs and TVs, money serves as a

a. Store of Value. b. Medium of Exchange. c. Standard of deferred payment. d. Unit of account. e. None of the above.

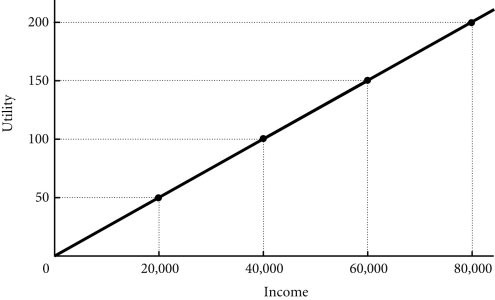

Refer to the information provided in Figure 17.2 below to answer the question(s) that follow.  Figure 17.2 Refer to Figure 17.2. Sam has two job offers when he graduates from college. Sam views the offers as identical, except for the salary terms. The first offer is at a fixed annual salary of $60,000. The second offer is at a fixed salary of $30,000 plus a possible bonus of $60,000. Sam believes that he has a 50-50 chance of earning the bonus. If Sam takes the offer that maximizes his expected utility and is risk-neutral, which job offer will he choose?

Figure 17.2 Refer to Figure 17.2. Sam has two job offers when he graduates from college. Sam views the offers as identical, except for the salary terms. The first offer is at a fixed annual salary of $60,000. The second offer is at a fixed salary of $30,000 plus a possible bonus of $60,000. Sam believes that he has a 50-50 chance of earning the bonus. If Sam takes the offer that maximizes his expected utility and is risk-neutral, which job offer will he choose?

A. Sam will take the first offer. B. Sam will take the second offer. C. Sam is indifferent between the offers-both yield the same expected utility. D. Indeterminate from the given information.