Describe Asset recognition, definition, and measurement

ASSET RECOGNITION, DEFINITION AND MEASUREMENT

Asset recognition means that the item is an accounting asset on the balance sheet. For an item to be an asset, it must meet both (1) the definition of an asset, and (2) the asset recognition criteria.

Asset Definition An asset is a probable future economic benefit that a firm controls

because of a past event or transaction. The definition of an asset is similar in U.S. GAAP

and IFRS. The word probable refers to that which can be reasonably expected or believed on the basis of available evidence. The inclusion of probable in the definition acknowledges that commercial activities occur in an uncertain environment.

Asset Recognition The three criteria for asset recognition are:

1 . The firm owns or controls the right to use the item.

2 . The right to use the item arises as a result of a past transaction or exchange.

3 . The future benefit has a relevant measurement attribute that can be quantified with sufficient reliability.

Not all future benefits qualify as assets; that is, although all assets provide future benefits, not all future benefits are assets. This is because a future benefit that qualifies as an accounting asset must meet the three recognition criteria, the first two of which are part of the definition of an asset. The third criterion pertains to recognition, not definition: an item that meets the definition of an asset must be measurable with sufficient reliability. Reliability of a reported amount means that the amount corresponds to what it purports to represent and is reasonably free from error and bias, in the sense that multiple independent measurers would agree on the amount. Neither U.S. GAAP nor IFRS specifies what amount of reliability is "sufficient," suggesting that this judgment is context-specific and subjective, not quantifiable.

You might also like to view...

______ is the degree to which people perceive outcomes to be fairly allocated.

A. Distributive justice B. Operational justice C. Mechanical justice D. Procedural justice

What are four techniques to use to open sales letters? Provide an example of at least four of the six techniques

There are certain transactions that are enforceable without consideration. These include:

a. promises to pay a debt barred by the statute of limitations. b. a promise to pay a debt that has been discharged in bankruptcy if certain requirements are met. c. a new promise to perform a voidable obligation that has not previously been avoided. d. All of these.

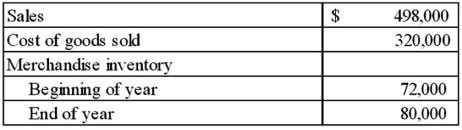

Selected financial information for Martin Company for Year 2 follows: Required:How many times did Martin's merchandise inventory turnover during Year 2? Round your answer to one decimal place.

Required:How many times did Martin's merchandise inventory turnover during Year 2? Round your answer to one decimal place.

What will be an ideal response?