Which of the following is not a lesson that history has taught about the development of physical and electronic currencies:

a. The private sector usually finds a way to circumvent these taxes and restrictions.

b. Commerce usually follows community.

c. To gain widespread trust and usage, currencies do not have to be backed by precious metals.

d. All of the statements are positive lessons. None is false.

.D

You might also like to view...

Education

A) does not really add to one's human capital. B) does not really affect one's income. C) is a major factor affecting one's income. D) explains all the differences in male-female incomes.

The change in total planned real expenditures resulting from a change in the real value of money balances when the price level changes, all other things held constant, is

A) the real-balance effect. B) the interest rate effect. C) the open economy effect. D) demand side inflation.

As a consumer you believe yourself to act rationally, optimally and self-interestedly. You like ice cream and value a pint at $7 . Usually you buy a pint each week at $4 . This week however, the price jumped to $5 a pint. What would you do?

a. buy the ice cream since the price is still below your maximum willingness to pay b. buy the ice cream since even at the new price it gives you a positive amount of consumer surplus c. not buy the ice-cream since the price is now higher d. both A&B

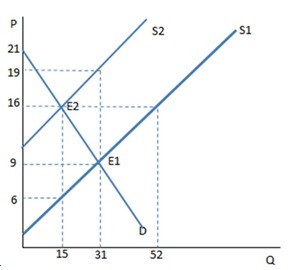

The graph shown demonstrates a tax on sellers. Which of the following can be said about the effect of this tax?

The graph shown demonstrates a tax on sellers. Which of the following can be said about the effect of this tax?

A. The tax creates a shortage, and rationing must occur. B. The tax creates a shortage, and the government must regulate the market. C. The tax creates a surplus, and the government must buy the excess. D. None of these is true.