The tax result to the corporation is

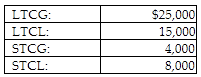

Summer Corporation has the following capital gains and losses during the current year:

A) $6,000 NSTCG included in gross income.

B) $6,000 NLTCG included in gross income.

C) $10,000 NLTCG is included in gross income and $4,000 NSTCL is carried forward to the next year.

D) $10,000 NLTCG receives long-term capital gain treatment and $4,000 NSTCL included as ordinary loss.

B) $6,000 NLTCG included in gross income.

$25,000 LTCG - $15,000 LTCL = $10,000 LTCG. $4,000 STCG - $8,000 STCL = $4,000 STCL. $10,000 LTCG - $4,000 STCL = $6,000 NLTCG.

You might also like to view...

If a credit memo appears on a bank reconciliation, this could be an indication that:

a. there has been a decrease the company's bank account b. there has been a bank service charge c. there has been a deposit of a customer's NSF check d. there has been a note receivable for the company that was collected by the bank.

Joe’s Donut Hole sold 1,500 donuts in January, 1,600 in February, and 1,550 in March. What is the three period simple moving average forecast for April?

a. The three period simple moving average cannot be determined from the information given b. 1,550 c. 1,600 d. 1,575

The International Students Club at Eastern University recently held an end-of-year dinner and swim party, which the treasurer declared to be a financial success. "Attendance was an all-time high, 60 members, and the results were much better than expected." The treasurer presented the following performance report at the executive board's June meeting:?BudgetActualVarianceRevenue$1,575$2,205$630FFood$675$870$195UBeverages315480165UDisc jockey15017525UFacility rental200200--- Total costs$1,340$1,725$385U Profit$235$480$245FThe budget was based on the assumptions that follow.· Forty-five members would attend at a fixed ticket price of $35.· Food and beverage costs were anticipated to be $15 and $7 per attendee, respectively.· A disc jockey was hired via a written contract at $50 per

hour.Required: A. Briefly evaluate the meaningfulness of the treasurer's performance report.B. Prepare a performance report by using flexible budgeting and determine whether the end-of-year party was as successful as originally reported.C. Based on your answer in requirement "B," present a possible explanation for the variances in revenue, food costs, beverage costs, and the disc jockey. What will be an ideal response?

Compute Steve's taxable income for 2018. Show all calculations.

Steve Greene, age 66, is divorced with no dependents. In 2018, Steve had income and expenses as follows: Gross income from salary $80,000 Total itemized deductions 5,500