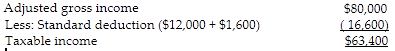

Compute Steve's taxable income for 2018. Show all calculations.

Steve Greene, age 66, is divorced with no dependents. In 2018, Steve had income and expenses as follows:

Gross income from salary $80,000

Total itemized deductions 5,500

You might also like to view...

Which of the following are important to consider when choosing a database management system?

A) Compatibility with your software and hardware B) Hardware and software requirements C) Familiarity and expertise of staff D) All of the above

The payment of cash dividends would have which of the following effects on the accounting equation?

A) Increase Liabilities B) Decrease Stockholders' Equity C) Increase Assets D) Increase Stockholders' Equity

The Safety Chemical Company produces a special kind of body oil that is widely used by professional sports trainers. The oil is produced in three processes: Refining, Blending, and Mixing. Raw oil materials are introduced at the beginning of the refining process. A "mountain-air scent" material is added in the blending process when processing is 50% completed.The following Work-in-Process account for the Refining Department is available for the month of July. The July 1 Work-in-Process balance contains $1,500 in material costs.Work-in-Process: Refining Beginning balance (5,000 gallons, 80% complete)$7,500 Materials (30,000 gallons) 12,300 Direct labor 14,500 Overhead 21,750 Ending balance (6,000 gallons, 2/3 complete) The Safety Chemical Company uses first-in, first-out

(FIFO) costing.Required (use 4 decimal places for computations):(a) Compute the equivalent units of production for Refining for July.(b) Compute the material cost per unit and the conversion cost per unit for July.(c) Compute the costs transferred to the Blending Department for July.(d) Compute the July 31 Work-in-Process Inventory balance. What will be an ideal response?

According to GAAP, interest cost incurred to finance construction of an asset must be capitalized in which of the following situations?

A. when the asset is inventory that is routinely manufactured in large quantities on a repetitive basis B. when an asset is used in other than the earning activities of the firm C. when an asset is ready for its intended use D. when an asset is being constructed for a firm's own use