Intraperiod tax allocation

A. is used to allocate a company's total income tax expense to the components of net income and comprehensive income.

B. involves temporary (timing) differences between financial and taxable incomes.

C. requires allocation of deferred taxes across accounting periods.

D. results from differences between tax regulations and the principles followed to determine financial income.

Answer: A

You might also like to view...

An important requirement of many laws and regulations governing products and services is that ______.

A. companies deliver value for the consumer B. companies meet certain quality standards C. companies deliver products and services at low prices D. companies deliver products and services within a short time of being ordered

Which of the following is NOT part of the capital budgeting process?

A) develop short-term operating strategies B) identify and analyze potential capital investments C) apply capital rationing D) perform post-audits

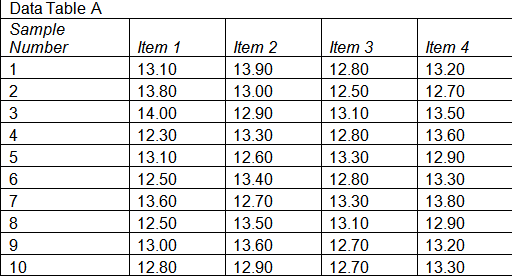

Refer to Data Table A. The mean of the ranges is ______.

a. 1.00

b. 0.7

c. 1.7

d. 0.27

Stuart and Melvin were employees of ANZ Construction Company. They both sustained serious injuries while working and took a week off. The company awarded Stuart $500 as compensation, but nothing was awarded to Melvin. In this case, Melvin has the right to present his grievances to his employer without intervention of bargaining representative under the:? A) ?Taft-Hartley Act

B) National Labor Relation Act.? C) ?Occupational Safety and Health Act. D) ?Fair Labor Standards Act.