What is the relationship between gross investment, net investment, and depreciation? Which measures the change in the capital stock?

What will be an ideal response?

Gross investment minus depreciation equals net investment. Gross investment is all the investment made during the year. Depreciation is the wear and tear on capital from its use and obsolescence. The "depreciation part" of gross investment goes to replace old, worn out capital and so net investment is the change in the capital stock.

You might also like to view...

Refer to Figure 28-2. Suppose the economy is at point B in the figure above. Which of the following is true?

A) The economy is producing at potential GDP. B) The expected rate of inflation is 3%. C) The natural rate of unemployment is 3.8%. D) The current unemployment rate is 5%. E) Expected inflation and actual inflation are the same.

Government transfer payments...

What will be an ideal response?

In the face of rising costs, some firms reduce the quality of the goods they produce rather than maintain quality and increase prices. How would behavioral economics explain this strategy?

A. People have an aversion to losses, and consumers are more likely to feel the loss of a price increase than a quality reduction. B. Consumers are more tolerant of diminished quality because diminishing marginal utility causes people to get rid of goods sooner than in the past. C. Firms are myopic in their decision making, with little regard for future profitability. D. The availability heuristic will cause people to buy whatever is offered, regardless of the quality.

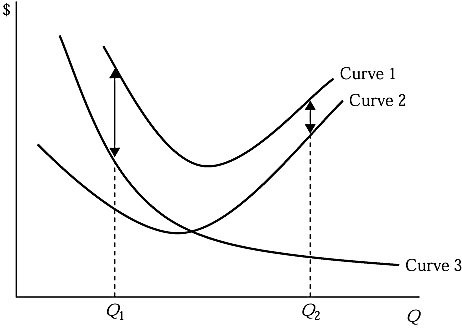

Refer to Figure 5.2, which shows a family of average cost curves. The average total cost curve is represented by:

Refer to Figure 5.2, which shows a family of average cost curves. The average total cost curve is represented by:

A. Curve 1. B. Curve 2. C. Curve 3. D. the vertical sum of curve 1 and curve 2.