Total banking system reserves equal $58.65 billion. The total banking system checkable deposits subject to reserve requirements are $510 billion. The required reserves are $51 billion. What is the required reserve rate, and what is the excess reserve rate?

What will be an ideal response?

Given the required reserves equal $51 billion and there are $510 billion in deposits; we can use the formula: rD =  where D = deposits and RR equals required reserves, and rD = the required reserve rate. Substituting in the amounts we find rD = 0.1 or ten percent. We can take the same approach to solving for the excess reserve if we first take the total amount of reserves which we will call R and realizing that R = RR + ER where ER is the amount in excess reserves. In this case, ER = R - RR or $7.65 billion. Now if we let rE represent the excess reserve rate, we can solve for it using the following equation: rE =

where D = deposits and RR equals required reserves, and rD = the required reserve rate. Substituting in the amounts we find rD = 0.1 or ten percent. We can take the same approach to solving for the excess reserve if we first take the total amount of reserves which we will call R and realizing that R = RR + ER where ER is the amount in excess reserves. In this case, ER = R - RR or $7.65 billion. Now if we let rE represent the excess reserve rate, we can solve for it using the following equation: rE =  and substituting in the actual values, we find that rE = 0.015 or 1.5 percent.

and substituting in the actual values, we find that rE = 0.015 or 1.5 percent.

You might also like to view...

The collapse of the Bretton Woods system marked

A) the end of floating exchange rates and a move to fixed exchange rates. B) marked the end of fixed exchange rates and a move to floating exchange rates. C) the beginning of the gold standard. D) a plunge in the price of gold. E) the elimination of paper currencies.

A(n) _____ implies an increase in human capital

a. addition of a new machine that laborers use in production b. increase in wealth c. more educated labor force d. increase in the number of schools in a country e. increase in the quantity of the capital used by a firm

If the price elasticity of demand is 4 and the price of migraine medicine increases by 6%, what will be the percentage change in quantity demanded?

a. 6% b. 4% c. 24% d. 67%

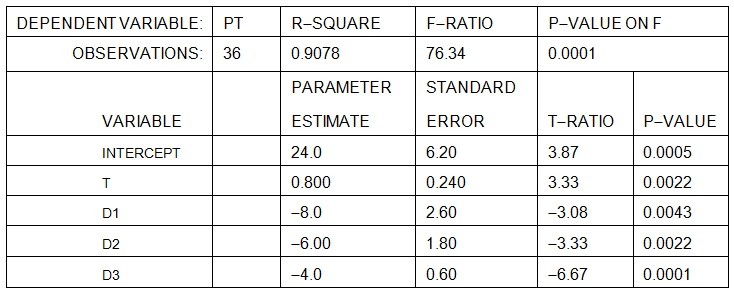

The manufacturer of Beanie Baby dolls used quarterly price data for 2005 I - 2013 IV (t = 1, ..., 36) and the regression equationPt = a + bt + c1D1t + c2D2t + c3D3tto forecast doll prices in the year 2014. Pt is the quarterly price of dolls, and D1t, D2t, and D3t are dummy variables for quarters I, II, and III, respectively.  The estimated QUARTERLY increase in price is ________, and the estimated ANNUAL increase in price is ________ .

The estimated QUARTERLY increase in price is ________, and the estimated ANNUAL increase in price is ________ .

A. $0.60; $2.40 B. $1.50; $6.00 C. $0.80; $3.20 D. $1.40; $4.00 E. none of the above