In the country of Darrowby, net domestic income at factor cost is $2.0 million. Gross domestic product is $3.0 million, and depreciation is $0.5 million. Indirect taxes less subsidies ________

A) are $1 million

B) are $0.5 million

C) cannot be calculated

D) are -$0.5 million

B

You might also like to view...

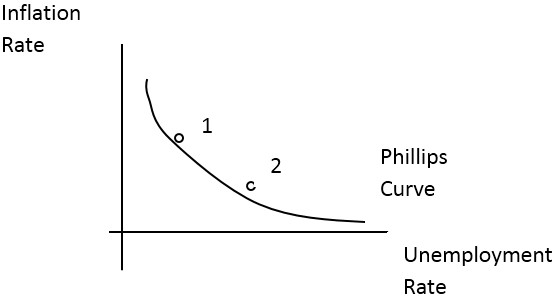

Use the following diagram to answer the next question. Which of the following would have caused a move from point 1 to point 2 in the diagram above?

Which of the following would have caused a move from point 1 to point 2 in the diagram above?

A. An increase in government spending. B. An increase in worker productivity. C. An increase in taxes. D. An increase in imports.

Normative economics

A) predicts the consequences of alternative actions. B) answers the question "What ought to be?" C) answers the question "What is?" D) is the focus of most modern economic reasoning.

Political candidates in a two-person race prefer to be viewed as occupying the center of the political distribution because

A) occupying the center is a sign of being a leader. B) political candidates usually prefer to maintain the status quo and the center is the status quo. C) the electorate is largely in the "wings" (extreme ends) of the political distribution. D) whoever comes closer to the center usually wins the election.

Which one of the following statements is TRUE?

A) In a proportional tax system, the marginal tax rate always exceeds the average tax rate. B) In a proportional tax system, the average tax rate always exceeds the marginal tax rate. C) The U.S. Social Security tax is proportional. D) The U.S. Social Security tax is regressive.