If the demand for a product is perfectly inelastic and the supply curve is upsloping, a $1 excise tax per unit of output will:

A. raise price by less than $1.

B. raise price by more than $1.

C. raise price by $1.

D. lower price by $1.

Answer: C

You might also like to view...

The change illustrated in the figure above can be the result of the Fed ________ government securities in the open market and will ultimately lead to ________ in aggregate demand

A) selling; an increase B) selling; no change C) buying; no change D) buying; an increase E) selling; a decrease

Explain the condition where society would be better off when more of a good is produced

What will be an ideal response?

The price index that measures the prices of goods and services purchased by firms is called the:

A. producer price index. B. purchasing power index. C. retail sales index. D. consumer price index.

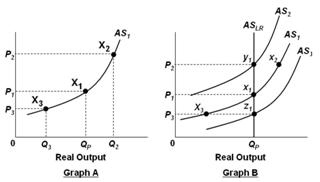

Refer to the graphs below. In Graph A, an increase in the price level from P1 to P2 will cause:

In the graphs below, QP refers to the economy's potential output level.

A. The nation's unemployment rate to be greater than the natural rate of unemployment

B. The nation's unemployment rate to be less than the natural rate of unemployment

C. Product prices to decrease

D. Profits to decrease