Suppose that the opportunity cost of producing goods differs between two nations. We can correctly state that

A) the two nations should not specialize in the production of goods.

B) specialization can lead to a decrease in the production of all goods.

C) specialization can lead to an increase in the production of all goods.

D) neither country has a comparative advantage in the production of any good.

Answer: C

You might also like to view...

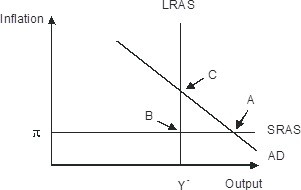

Refer to the figure below.________ inflation will eventually move the economy pictured in the diagram from short-run equilibrium at point ________ to long-run equilibrium at point ________,

A. Rising; B; C B. Falling; A; C C. Falling; A; B D. Rising; A; C

Refer to the above figure. Suppose the economy is in equilibrium at point A

If the Fed tries to stimulate the economy by undertaking an expansionary monetary policy action and this is not expected by the people in the economy, we would expect to see A) aggregate supply shifts up as people anticipate the effects of the expansionary monetary system. In the short run, real GDP falls to $13 trillion and the price level rises to 120. In the long run, real GDP returns to $14 trillion, and the price level increases further, to 150. B) aggregate demand increases but people would anticipate this, causing the short-run aggregate supply curve to shift up at the same time, with the new equilibrium of $14 trillion of real GDP and a price level of 100. C) aggregate demand increases, real GDP increases, and the price level increases in the short run. In the long run, people realize the real situation, causing the short-run aggregate supply curve to shift u

Refer to Table 20-12. Consider a simple economy that produces only three products: burritos, flashlights, and golf balls. Use the information in the table to calculate the inflation rate for 2016, as measured by the consumer price index

What will be an ideal response?

By the 2000s, an important change in the mortgage market had occurred when ________ became significant participants in the secondary market for mortgages by buying, bundling, and reselling mortgages as mortgage-backed securities

A) commercial banks B) investment banks C) financial markets D) foreign governments