You require an internal rate of return of 8% to accept a project. If the project will yield $10,000 per year for 10 years, what is the maximum amount that you would be willing to invest in the project?

A) $51,400

B) $67,100

C) $100,000

D) $144,870

B) $67,100

Appendix D

PVIFA(10 periods, 8%) = ($ Investment/$10,000)

6.710 = ($ Investment/$10,000)

Maximum investment = $67,100

Note that Appendix D CAN be used in this case because the cash inflows remain the same during the payback period, thereby making this an "annuity."

You might also like to view...

Making decisions to listen to some messages while ignoring others is

A) selective attention B) a self-ful?lling prophecy C) a halo effect D) projection

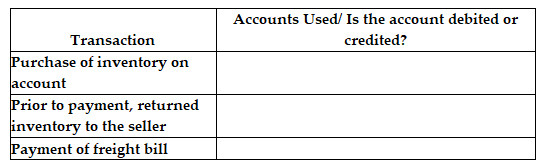

The following transactions apply to a company that uses a periodic inventory system. For each transaction, state which accounts are used and whether the account is debited or credited. All transactions involve the purchase of inventory.

In a flow chart, activities or steps are usually indicated by _________________

a. squares and rectangles b. triangles and diamonds c. a series of arrows d. the color blue

Ofelia and Teresa share income and losses in a 2:1 ratio after allowing for salaries to Ofelia of $48,000 and $60,000 to Teresa. Net income for the partnership is $132,000. Income should be divided as follows:

A) Ofelia, $56,000; Teresa, $76,000 B) Ofelia, $60,000; Teresa, $72,000 C) Ofelia, $72,000; Teresa, $60,000 D) Ofelia, $64,000; Teresa, $68,000