Which of the following is a difference between a C corporation and an S corporation?

A. The members of a C corporation have unlimited liability, whereas the members of an S corporation enjoy limited liability.

B. The members of a C corporation have limited liability, whereas the members of an S corporation have unlimited liability.

C. A C corporation is double taxed, whereas an S corporation is taxed as a partnership.

D. A C corporation is taxed as a partnership, whereas an S corporation is double taxed.

Answer: C

You might also like to view...

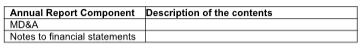

Provide a description of the contents of each of the following components of the annual report.

What targets sales opportunities by finding new customers or companies for future sales?

A. Sales management system B. Contact management system C. Opportunity management system D. Sales force automation system

A core process is a set of activities that delivers value to external customers

Indicate whether the statement is true or false

The percent-of-sales method of developing a pro forma income statement forecasts sales and other line items as a ________

A) percentage of projected sales B) percentage of average sales over a period C) percentage of projected total assets D) percentage of average total assets over a period