Identify two variables that shift the desired investment curve. Is desired investment negatively related or positively related to each of these variables?

What will be an ideal response?

Variables that shift the desired investment curve are the real interest rate, the expected future marginal product of capital, and the effective tax rate. Desired investment is positively related to the future marginal product of capital, but negatively related to the real interest rate and the effective tax rate.

You might also like to view...

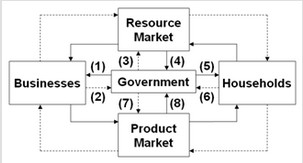

Use the following diagram to answer the next question. In the diagram, solid arrows reflect real flows and broken arrows are monetary flows. Flow (3) might represent

In the diagram, solid arrows reflect real flows and broken arrows are monetary flows. Flow (3) might represent

A. government salaries paid to school teachers. B. a state university's purchase of computers. C. property tax payments. D. social security payments to retirees.

A monopsonist can choose the ____________, while a monopolist can choose the ___________

a. price it will charge; wage rate it will pay b. wage rate it will pay; price it will charge c. price for its output; quantity it will produce d. marginal product of labor; marginal cost of labor e. number of competitors; number of buyers

As a result of the recent financial crisis, some analysts believed that the MPC in the U.S. declined. If this is true, the value of the multiplier is now

a. smaller. b. larger. c. the same. d. magnified to a larger amount.

Which statement about leveraging is true?

a. It is safer for banks to have a high level of leverage than a low level of leverage. b. A higher amount of leveraging means a higher potential for profit. c. Financial institutions avoid being highly leveraged due to the potential for loss. d. Banks can only use their own money as leverage.