An interesting development that happened in late 2008, relating to the Fed and bank reserves, is that the Fed:

A. Reduced the reserve ratio drastically

B. Required banks to hold more excess reserves

C. Started paying interest on the banks' reserves

D. Gave back all the reserves to the banks to hold as vault cash

C. Started paying interest on the banks' reserves

You might also like to view...

Time series variables fail to be stationary when

A) the economy experiences severe fluctuations. B) the population regression has breaks. C) there is strong seasonal variation in the data. D) there are no trends.

Half of all your potential customers would pay $10 for your product but the other half would only pay $8 . You cannot tell them apart. Your marginal costs are $4 . If you set the price at $8, the expected profit is:

a. $3 b. $4 c. $5 d. $6

Suppose that a nation has adopted a fixed exchange rate with another country, and has a persistent trade deficit. What is most likely to happen?

a. a gradual increase in the value of its currency b. a gradual decrease in the value of its currency c. a "run" on its currency and a sudden appreciation d. a "run" on its currency and a sudden devaluation

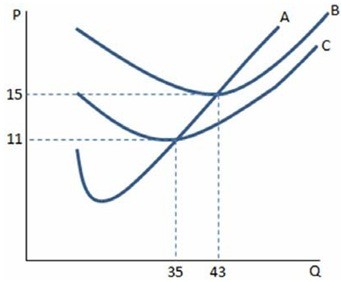

If a firm in a perfectly competitive market faces the curves in the graph shown and observes a market price of $16, the firm:

If a firm in a perfectly competitive market faces the curves in the graph shown and observes a market price of $16, the firm:

A. can make positive profits by producing less than 43 units. B. cannot make positive profits and should shut down in the short run. C. can make positive profits by producing where MC = MR. D. should continue to operate in the short run, but plan to exit in the long run.