Allowing for the return of unwanted merchandise and providing for product exchanges are necessary to maintain customers' trust and loyalty

Indicate whether the statement is true or false

TRUE

You might also like to view...

Protective Corporation acquired 70 percent of the common shares and 60 percent of the preferred shares of Safety Corporation at underlying book value on January 1, 20X6. At that date, the fair value of the noncontrolling interest in Safety's common stock was equal to 30 percent of the book value of its common stock. Safety's balance sheet at the time of acquisition contained the following balances: Assets$700,000 Liabilities$110,000 Preferred Stock 100,000 Common Stock 200,000 Retained Earnings 290,000 Total Assets$700,000 Total Liabilities and Equities$700,000 The preferred shares are cumulative and have an 8 percent annual dividend rate and are three years in arrears on January 1, 20X6. All of the $10 par value preferred shares are callable

at $12 per share. During 20X6, Safety reported net income of $80,000 and paid no dividends.Based on the information provided, what is the book value of the common stock on January 1, 20X6? A. $390,000 B. $490,000 C. $446,000 D. $420,000

The __________ is an orderly compilation of the general common law of the United States, prepared by a distinguished group of lawyers, judges, and law teachers

a. statute of frauds b. Uniform Commercial Code c. Maxims d. Restatement of Law

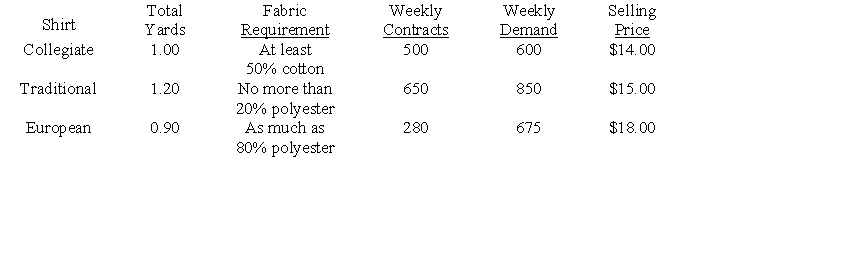

Formulate and solve this blending problem as a linear program.

Target Shirt Company makes three varieties of shirts: Collegiate, Traditional, and European. These shirts are made from different combinations of cotton and polyester.

The cost per yard of unblended cotton is $5 and for unblended polyester is $4. Target can receive up to 4000 yards of raw cotton and 3000 yards of raw polyester fabric weekly. The table below gives pertinent data concerning the manufacture of the shirts.

What are two dos of effective delegation?

What will be an ideal response?