The new classical model implies that a shift to a more expansionary fiscal policy (the substitution of debt financing for taxes) will

a. stimulate aggregate demand and employment.

b. retard aggregate demand and employment.

c. increase the real rate of interest.

d. exert little or no impact on the real interest rate, aggregate demand, and employment.

D

You might also like to view...

Which of the following would be an example of a transaction later regretted because it was made with incomplete information?

A. Sue purchased a lottery ticket that did not win her any money. B. Larry moved to a new apartment but later decided it was too small for his needs. C. Tim bought products from a seller that knew they were defective. D. All of these are good examples of incomplete information.

Suppose there is an increase in the price of oranges. Which of the following is a possible cause?

a. increase in income b. increase in the price of sugar, a complement of oranges c. decrease in the price of tangerines, a substitute for oranges d. freeze in Florida e. favorable weather pattern

If a competitive price-taking firm is operating in long-run equilibrium and market demand suddenly falls, the short-run result will be

a. greater economic profit. b. a normal profit. c. lower average total cost. d. lower average variable cost. e. economic losses.

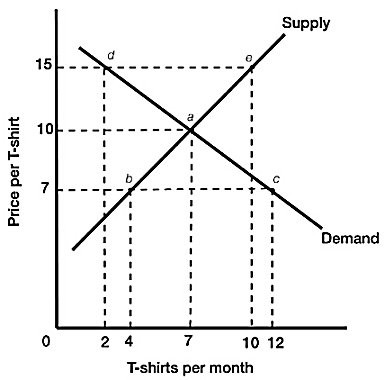

Figure 3.3 illustrates the supply and demand for t-shirts. If the actual price of t-shirts is $15, we would expect that:

Figure 3.3 illustrates the supply and demand for t-shirts. If the actual price of t-shirts is $15, we would expect that:

A. demand will decrease until quantity demanded equals quantity supplied. B. supply will increase until quantity demanded equals quantity supplied. C. price will decrease until quantity demanded equals quantity supplied. D. there will be no change in the price since the market is in equilibrium.