Chopin Co. sells product A. The beginning inventory for product A was 70 units @ $240 per unit. During the year, Chopin purchased 110 units of product A at $216 per unit. The company sold 140 units of product A @ $400 per unit at the end of the year. Required: Determine the amount of product cost that would be allocated to cost of goods sold and ending inventory using (1) FIFO, (2) LIFO, and (3) weighted average.

What will be an ideal response?

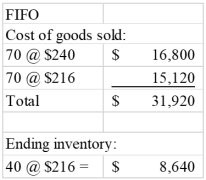

(1) FIFO:

Cost of goods sold = $31,920

Ending inventory = $8,640

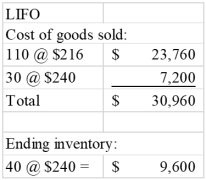

(2) LIFO: Cost of goods sold = $30,960

Ending inventory = $9,600

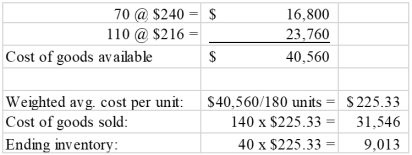

(3) Weighted Average:

Cost of goods sold = $40,560

Ending inventory = $9,013

(1) FIFO

(2) | LIFO |

(3) | Weighted Average |

You might also like to view...

Briefly explain several guidelines for adapting marketing and sales messages for social media

What will be an ideal response?

Many times a financial analyst may decide to make adjustments to the financial statements in order to make the statements more useful. Which of the following would not require an adjustment to the financial statement?

a. A company signs a new contract with a customer. b. A delivery company incurs a loss from disposition of used delivery trucks. c. A company changes the useful life of its equipment from 5 years to 8 years. d. A company incurs a charge related restructuring its operations.

Explain how a business plan is like a road map

What will be an ideal response?

______ is a set of standard tests for fairness in disciplinary actions that were originally utilized in union grievance arbitrations.

A. Just Cause B. Serious Misconduct C. Coaching D. Gross Negligence