Find the Social Security tax and Medicare tax on the annual gross income of a self-employed individual. For a self-employed person, the FICA rate is 12.4% and the Medicare rate is 2.9%. Round to the nearest cent if needed.Ted Houston, accountant, earned $42,999.57

A. $2665.97, $623.49

B. $2665.97, $1246.99

C. $5331.95, $1246.99

D. $5231.95, $1146.99

Answer: C

You might also like to view...

Sketch a typical level surface for the function.f(x, y, z) = e(x2 + y2 + z2)

A.

B.

C.

D.

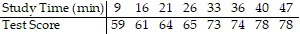

Plot and interpret the appropriate scatter diagram.The table shows the study times and test scores for a number of students. Draw a scatter plot of score versus time treating time as the independent variable.

What will be an ideal response?

Find two square roots for the complex number. Write your answer in standard form.

?

What will be an ideal response?

Devin pays $243 in advance on his account at the athletic club. Each time he uses the club, $6 is deducted from the account. The balance remaining in his account after x visits to the club can be modeled by the equation B(x) = 243 - 6x. Find the number of times Devin has been to the club when the account balance is $171.

A) 11 B) 13 C) 14 D) 12 E) None of these