Economic Profit exists whenever

A. a firm makes more than its competitors.

B. a firm makes even one penny.

C. A firm makes enough, so that it is required to pay taxes.

D. a firm makes more than the minimum required to maintain the incentive to remain in the industry.

Answer: D

You might also like to view...

If the price of food falls by 10 percent and the quantity sold increases by 5 percent, then the price elasticity of demand in that range equals

a. 2, and demand is elastic b. 0.5, and demand is elastic c. 2, and demand is inelastic d. 0.5, and demand is inelastic e. 15, and demand is elastic

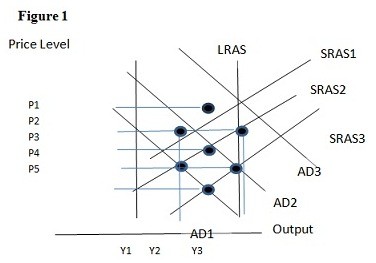

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD1 the result in the long run would be:

A. P4 and Y1. B. P4 and Y2. C. P5 and Y1. D. P5 and Y2.

Tax incidence refers to

A) determining who sends the taxes into the government. B) the tendency of some people to avoid paying taxes at all. C) the distribution of tax burdens among groups, or who really pays a tax. D) determining the marginal tax rate applied to any increase in income.

Suppose that opportunity costs in India and Thailand are constant. In India, maximum feasible hourly production rates are either 0.3 unit of cloth or 0.2 unit of food. In Thailand, maximum feasible hourly production rates are either 0.5 unit of cloth or 0.5 unit of food. It is correct to state that

A. Thailand has a comparative advantage in producing cloth. B. India has a comparative advantage in producing both cloth and wheat. C. India has a comparative advantage in producing cloth. D. India has no comparative advantage in producing cloth or wheat.