Fiscal policy

What will be an ideal response?

Government policy that attempts to manage the economy by controlling taxing and spending.

You might also like to view...

Which of the following taxes is based on the benefits-received principle?

a. corporate income taxes b. personal income taxes c. property taxes d. gasoline excise taxes e. user fees that collect the same amount from each person

If there's demand-pull inflation in the economy, then government policy should

a. increase taxes and cut spending, which would shift AD to the left b. increase taxes and spending, which would shift AD to the left c. decrease taxes and spending, which would shift AD to the left d. decrease taxes and increase spending, which would shift AD to the right e. increase taxes and cut its spending, which would shift AS to the left

Which of the following policies can be adopted by the Fed in order to stimulate an economy in the short run?

What will be an ideal response?

Refer to the table below. If the price of A decreases, while the price of B and the consumer's income stay the same, we would expect:

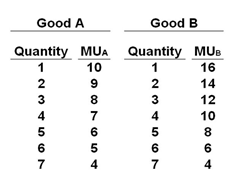

The table below shows the marginal-utility schedules for goods A and B for a hypothetical consumer. The price of good A is $1 and the price of good B is $2. The income of the consumer is $8.

A. MU/P of A to increase, and the consumers will thus buy less of B

B. MU/P of A to increase, and the consumers will thus buy less of A

C. MU/P of A to decrease, and the consumers will thus buy less of B

D. MU/P of A to decrease, and the consumers will thus buy less of A