Diedrich Corporation makes a product with the following costs: Per UnitPer YearDirect materials$20.80 Direct labor$15.20 Variable manufacturing overhead$1.30 Fixed manufacturing overhead $1,252,900 Variable selling and administrative expenses$4.20 Fixed selling and administrative expenses $1,581,200 ?The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 67,000 units per year.The company has invested $420,000 in this product and expects a return on investment of 12%.Direct labor is a variable cost in this company.?The selling price based on the absorption costing approach is closest to:

A. $56.32

B. $83.80

C. $84.56

D. $126.53

Answer: C

You might also like to view...

Brett has a headache and needs a pain reliever. He goes to the nearby drugstore, buys some Tylenol, and uses it. Which of the following benefits offered by stores can be seen in the given example?

A. Immediate gratification B. Browsing C. Risk reduction D. Entertainment and Social experience E. Personal service

Seattle, Inc, is contemplating a project that costs $180,000 . Expectations are that annual cash revenues will be $70,000 and annual expenses (including depreciation) will total $30,000 . The project has a six-year useful life and a residual value of $30,000 . Assume Seattle Inc uses straight line method of depreciation. The accounting rate of return for the project is

a. 53.3 percent. b. 22.2 percent. c. 66.7 percent. d. 38.1 percent.

On December 31 . 2014, Omar Corporation's current liabilities total $60,000 and long-term liabilities total $160,000 . Working capital at December 31 . 2014, is equal to $90,000 . If Omar Corporation's debt-to-equity ratio is .40 to 1 . total long-term assets must equal

a. $620,000. b. $770,000. c. $550,000. d. $680,000.

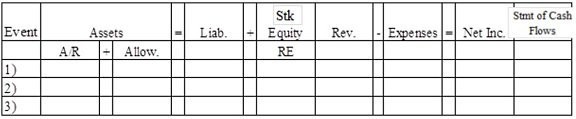

Pena Company experienced the following events during Year 1:1)Recognized $17,000 of service revenue on account2)Wrote off as uncollectible an account receivable, $70.3)Prepared the adjusting entry to recognize uncollectible accounts expense. Pena expected that 2% of service revenue would not be collectedRequired: Show how each of these events would affect the elements of the financial statements using the table shown below. Include dollar amounts of increases and decreases. When an account is not affected by a particular event, indicate with NA.

What will be an ideal response?