Suppose that the MRP of the sixth acre of land is $200 and the rent paid on that land is $200. We can say that

A. not enough land is being rented.

B. just enough land is being rented.

C. too much land is being rented.

B. just enough land is being rented.

You might also like to view...

When the government charges an output tax to eliminate an externality, it forces the manufacturer to ________ the negative externality

A) charge customers for B) internalize C) stop producing D) increase the production of

Which of the following things can a government do to lower the costs of inflation?

a. sell inflation-indexed bonds and rewrite tax laws so that real rather than nominal gains are taxed b. sell inflation-indexed bonds but not rewrite tax laws so that real rather than nominal gains are taxed c. rewrite tax laws so that real rather than nominal gains are taxed, but not sell inflation-indexed bonds d. neither sell inflation-indexed bonds nor rewrite tax laws so that real rather than nominal gains are taxed

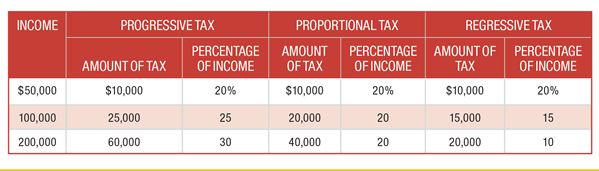

Based on the table demonstrating three tax systems, with these tax rates, which system(s) would bring in the lowest total revenue?

a. progressive

b. proportional

c. regressive

d. both regressive and proportional

If your taxable income was $50,000 and you had an average tax rate of 20 percent, how much tax did you pay?

What will be an ideal response?