To date, how many women has Project Shakti assisted?

a. Less than 70,000

b. Approximately 50,000

c. 250,000 and growing

d. More than 70,000

d. More than 70,000

You might also like to view...

Through _____, an employee can be easily shifted from stockperson to cashier as the need arises

a. cross-training b. risk-minimization retailing c. rationalized retailing d. job standardization

What was the impact of the 2008-09 U.S. financial crisis and the nations investment banks?

What would be an ideal response?

What is the amount of the acquisition differential amortization for 2018 (excluding goodwill impairment)?

On January 1, 2018, Hanson Inc. purchased 54,000 voting shares out of Marvin Inc.'s 90,000 outstanding voting shares for $240,000. On that date, Marvin's common shares and retained earnings were valued at $60,000 and $90,000, respectively. Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment, which was estimated to have a fair value that was $50,000 in excess of its recorded book value. The equipment was estimated to have a useful life of eight years. Both companies use straight line amortization exclusively.

On January 1, 2019, Hanson purchased an additional 9,000 shares of Marvin Inc. on the open market for $45,000. On this date, Marvin's book values were equal to its fair values with the exception of the company's equipment, which is now thought to be undervalued by $60,000. Moreover, the equipment's estimated useful

life was revised to 5 years on this date.

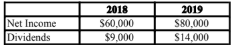

Marvin's net income and dividends for 2018 and 2019 are as follows:

Marvin's goodwill suffered an impairment loss of $5,000 during 2018. Hanson Inc. uses the equity method to account for its investment in Marvin Inc.

A) $6,250 B) $5,625 C) $12,000 D) $4,375

Answer the following statements true (T) or false (F)

1. Refunding a bond occurs when the company sells more bonds of the same series with maturity and a coupon equal to the bonds sold earlier. 2. A bond can only be easily refunded if it has a call feature. 3. The costs of bond refunding are the call premium and the underwriting costs on the old and new bond issue. 4. The payment of a call premium may generally be taken as an immediate tax write-off. 5. The costs of bond refunding are the call premium and the underwriting cost on the new bond issue.