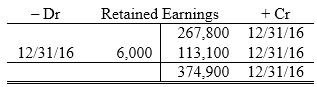

On December 31, 2018, Ditka Inc. had Retained Earnings of $267,800 before its closing entries were prepared and posted. During 2018, the company had service revenue of $168,100 and interest revenue of $81,300. The company used supplies in the amount of $87,900, advertising expenses were $16,400, salaries and wages totaled $18,300, and income tax expense was calculated as $13,700. During the year, the company declared and paid dividends of $6,000.Required:Part a. Prepare the closing entries dated December 31, 2018. Part b. Prepare T-account for the Retained Earnings account. Enter the beginning balance into the T-account, post the closing entries, and then determine the ending balance.

What will be an ideal response?

Part a.

| Service Revenue | 168,100 | ? |

| Interest Revenue | 81,300 | ? |

| Supplies Expense | ? | 87,900 |

| Advertising Expense | ? | 16,400 |

| Salaries and Wages Expense | ? | 18,300 |

| Income Tax Expense | ? | 13,700 |

| Retained Earnings | ? | 113,100 |

| ? | ? | ? |

| Retained Earnings | 6,000 | ? |

| Dividends | ? | 6,000 |

Part b.

You might also like to view...

Answer the following statements true (T) or false (F)

1. Despite the number of women in the workforce, Hofstede’s research indicates that the United States is a very masculine culture. 2. Both Americans and Japanese view compliments as a positive way to improve their image. 3. According to CAT, minority employees should diverge if they want to achieve higher status in the organization. 4. High employee performance leads to an LMX relationship. 5. Middle-group relationships are the ideal relationships to have in an organization because they lead to the best performance.

Which part of the leadership definition offered in the textbook gives leadership its ethical tone?

A. group B. process C. influence D. common goals

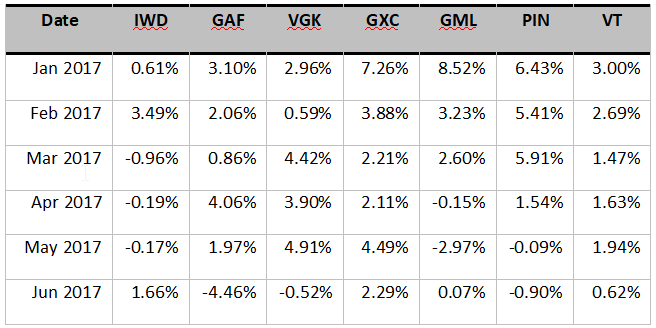

Being frustrated about the performance of your portfolio, you decide to verify the benefits of international diversification. You have selected several exchange-traded funds (ETFs) that invest in equity market indices of several world regions, including a world equity index, in an attempt to evaluate a well-diversified international portfolio. The regions you have selected are the following: Latin America (GML), Middle East & Africa (GAF), Europe (VGK), China (GXC), India (PIN), U.S. (IWD), and the entire world (VT). You have gathered the monthly returns of these ETFs from January to June 2017. The returns are in the following table:

a) Determine the average returns and standard deviations of each ETF. Also, determine the correlation coefficient and covariance of the American ETF (IWD) with the other ETFs of the rest of the world.

b) Determine the best and worst performer on a risk/return basis during this period. Use the Sharp ratio and assume that the relevant risk-free rate was 3%.

c) What is the expected return and standard deviation for an equally weighted portfolio that includes all ETFs except VT (world index ETF)? Are these results similar to those of VT?

d) Using the Solver, what is the minimum standard deviation that could be achieved by combining these ETFs into a portfolio, with the exception of VT? What are the exact weights of these ETFs? Assume short sales are not allowed.

Gross margin is defined as gross profit:

A. minus total operating expenses. B. divided by net sales revenues. C. divided by cost of sales. D. minus net income.