The person least likely to receive a payment from a corporation in a year of losses is the

A) bank that loaned money to the corporation.

B) bondholder.

C) preferred stockholder.

D) common stockholder.

Answer: D

You might also like to view...

A reduction of the discount rate by the Federal Reserve Banks has the direct effect of

A) making it less costly for commercial banks to borrow from the Fed. B) making it more costly for the Treasury to finance deficits. C) increasing commercial bank reserves. D) increasing the stock of money. E) doing all of the above.

The higher the HHI

A) the less dominated a market is by a single firm. B) the more competitive is the market. C) the more dominated a market is by a single firm. D) the less likely the Sherman Act will be applied to a firm.

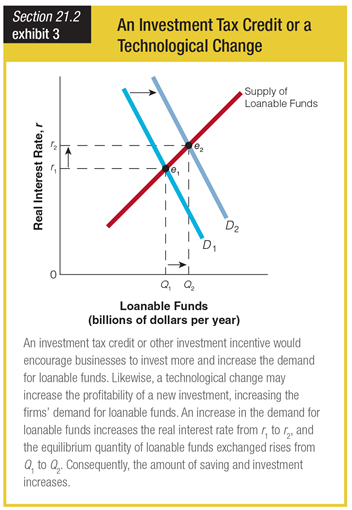

Based on the graph showing the effects of an investment tax credit or a technological change, enacting an investment tax credit would ______.

a. create a negative real interest rate

b. have little or no effect on the real interest rate

c. increase the real interest rate

d. decrease the real interest rate

Event risk is the possibility that

A. the overall price level will rise faster than expected, so that the lender is repaid in dollars that are worth less than the lender expected. B. a borrower will face some circumstance that will prevent the borrower from paying the loan back. C. a major catastrophic occurrence, such as a hurricane, flood, or terrorist attack, will lower the return on the investment. D. the lender will go bankrupt before the loan is fully repaid.