Sarah buys little stuffed animals for $5 each. They come in different varieties. If the producer stops making (retires) a certain variety, a stuffed animal of that variety will be worth $100; otherwise it is worth $0. There is 50% chance that any variety will be retired. When Sarah buys her next stuffed animal, the expected profit is

A) $50.

B) $47.50.

C) $45.00.

D) $0.

C

You might also like to view...

At various times, the United States has undergone the painful process of reducing military spending. Military bases from the Carolinas to California pleaded to be spared, citing huge job losses if they close. How can one rationally decide which bases to shut down, given the necessity of jobs?

What will be an ideal response?

Which of the following statements about the real loanable funds market is not true?

a. Movements in the real risk-free interest rate cause significant changes in borrowers' willingness and ability to tap the domestic credit market if the demand is highly elastic. b. The more elastic a nation's supply of real loanable funds, the less sensitive domestic savers, banks, foreigners, and governments are to changes in the real risk-free interest rate. c. Monetary policy is usually stronger in nations with elastic real loanable funds demands. d. Fiscal policy is usually weaker in nations with elastic loanable funds demands. e. All of the above are true.

Which of the following is/are NOT price-setting oligopoly models?

A. Stackelberg and Cournot. B. Cournot. C. Bertrand. D. Stackelberg.

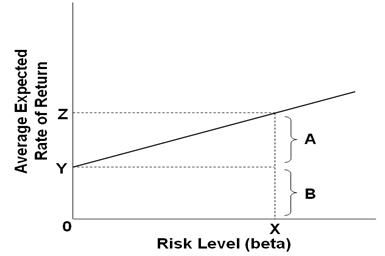

Explain the relationship displayed on the graph based on a risk level of X. Use the other capital letters on the graph to identify: (a) the average expected return for a risk-free asset; (b) the average expected return for a market portfolio with a risk level of X; (c) the compensation for time preference for a risk-free asset; and (d) the risk premium for the market portfolio’s risk level of X.