In the Keynesian model, suppose the Fed sets a target for the real interest rate. If the IS curve shifts up and to the right, and the Fed wants to keep output unchanged in the short run and the price level unchanged in the long run, it will

A) shift the LR curve up.

B) not shift the LR curve.

C) shift the LR curve down.

D) shift the IS curve up and to the right.

A

You might also like to view...

A necessary condition for "perfect competition" is

A) price searchers. B) price takers. C) legal restrictions on entry into the market. D) a small number of huge firms. E) widespread and long-run economic profits.

Union membership is likely to fall as growth in tertiary employment occurs in the private sector

Indicate whether the statement is true or false

Assume that the expectation of declining housing prices cause households to reduce their demand for new houses and the financing that accompanies it. If the nation has low mobility international capital markets and a flexible exchange rate system, what happens to the quantity of real loanable funds per time period and net nonreserve-related international borrowing/lending in the context of the

Three-Sector-Model? a. The quantity of real loanable funds per time period falls, and net nonreserve-related international borrowing/lending becomes more negative (or less positive). b. The quantity of real loanable funds per time period rises, and net nonreserve-related international borrowing/lending becomes more negative (or less positive). c. The quantity of real loanable funds per time period falls, and net nonreserve-related international borrowing/lending becomes more positive (or less negative). d. The quantity of real loanable funds per time period and net nonreserve-related international borrowing/lending remain the same. e. There is not enough information to determine what happens to these two macroeconomic variables.

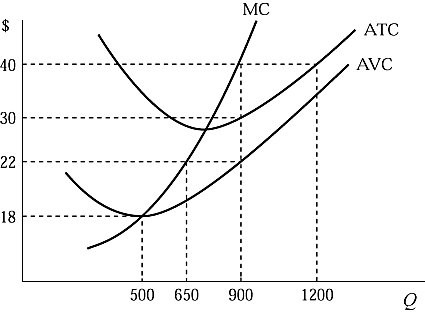

Figure 6.1 shows the cost structure of a firm in a perfectly competitive market. If the market price is $40 and the firm is currently producing the profit-maximizing output level, its total variable cost is:

Figure 6.1 shows the cost structure of a firm in a perfectly competitive market. If the market price is $40 and the firm is currently producing the profit-maximizing output level, its total variable cost is:

A. $12,500. B. $14,300. C. $19,800. D. $27,000.