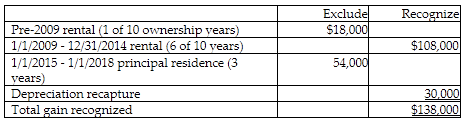

Hannah, a single taxpayer, sold her primary residence on January 1, 2018. Her total realized gain is $210,000. The house was acquired on January 1, 2008, and rented to tenants until December 31, 2014. Hannah moved in on January 1, 2015, and used the house as her principal residence until the sale. During the rental period, $30,000 of depreciation was deducted. Due to the sale of the house in

2018, Hannah will recognize a gain of

A) $147,000.

B) $30,000.

C) $156,000.

D) $138,000.

D) $138,000.

Of the $210,000 total gain, the $30,000 of prior depreciation must be recognized. The $180,000 balance of the gain will be divided into:

You might also like to view...

The use of budgeting, statistical reports, and performance appraisals to regulate behavior and results is considered a component of

A. market control. B. management audits. C. bureaucratic control. D. financial audits. E. clan control.

Different organizations have basic norms that govern which emotions should be displayed and which should be suppressed. What are these norms called?

A. emotional dissonance B. display rules C. house rules D. emotional regulation

Explain why selective attention is not controllable by a marketer

What will be an ideal response?

The U.S. avoids trade barriers on imports in support of free trade principles.

Answer the following statement true (T) or false (F)