Any increase in the present value of taxes implies

A) an increase in lifetime wealth and an increase in the current labor supply.

B) an increase in lifetime wealth and a decrease in the current labor supply.

C) a decrease in lifetime wealth and an increase in the current labor supply.

D) a decrease in lifetime wealth and a decrease in the current labor supply.

C

You might also like to view...

Answer the following statement(s) true (T) or false (F)

1. Comparative risk analysis is aimed at minimizing the absolute level of a risk. 2. Risk-benefit analysis and benefit-cost analysis are examples of risk management strategies. 3. President Regan’s Executive Order 12291 called for the explicit use of risk-benefit analysis. 4. Economists support the use of allocative efficiency as a criterion to identify the “acceptable” level of risk. 5. In the United States, all environmental laws setenvironmental risk at a level where the MSB equals the MSC.

Unlike perfectly competitive firms, monopolists produce where marginal revenue intersects marginal cost.

Answer the following statement true (T) or false (F)

Explain why a monopoly or a perfectly competitive firm does not consider a rival firm's behavior, but an oligopoly and a monopolistically competitive firm do

What will be an ideal response?

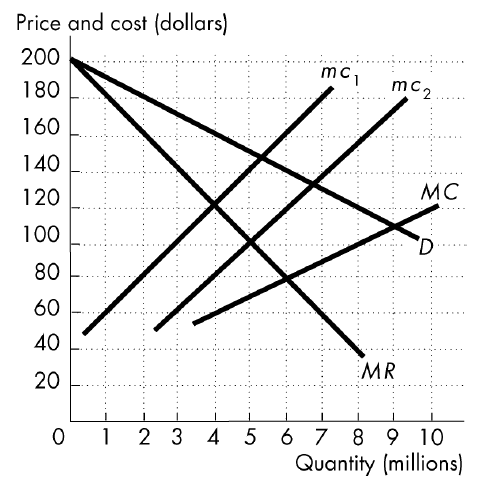

The figure below shows a firm that has two plants. Plant 1 has a marginal cost curve of mc1, plant 2 has a marginal cost curve of mc2, and the overall marginal cost curve is MC. Managers maximize their profit by producing ________ units at plant 1 and ________ units at plant 2.

A) 2 million; 4 million

B) 0; 5 million

C) 4 million; 5 million

D) None of the above answers is correct.