Bank regulation differs from monetary policy, because:

a. Monetary policy is concerned with controlling and monitoring the conduct, performance, and condition of financial institutions, but bank regulation is concerned with changing the monetary aggregates.

b. Regulation is concerned with changing reserve requirements, open market operations, and the discount rate, but monetary policy is concerned with changing the domestic interest rates.

c. Regulation is concerned with changing domestic interest rates, but monetary policy is concerned with changing reserve requirements, open market operations, and the discount rate.

d. Regulation is concerned with controlling and monitoring the conduct, performance, and condition of financial institutions, but monetary policy is concerned with changing the monetary aggregates.

.D

You might also like to view...

Overexpansion can cause a perfectly competitive firm to ________.

A) produce at a quantity where the market price exceeds the firm's average total cost B) produce at a quantity where the marginal revenue exceeds the firm's average total cost C) produce at a quantity where the average total cost exceeds the market price D) earn economic profit

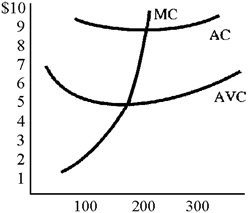

Figure 10-8

For the perfectly competitive firm in Figure 10-8, what is the long-run price and quantity?

a.

P = 4, Q = 150

b.

P = 9, Q = 200

c.

P = 10, Q = 200

d.

P = 5, Q = 150

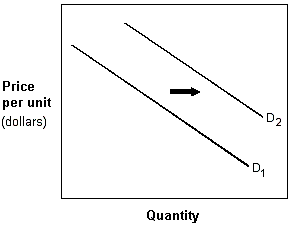

Exhibit 3-2 Demand curves

A. Decrease in price. B. Increase in expected future prices. C. Increase in the price of a complement. D. Decrease in income if it is a normal good.

It is less likely for oligopolists to maintain high prices in a repeated game than when the firms must choose one strategy to follow for the entire lifetime of the firm.

Answer the following statement true (T) or false (F)