As a manager, George is flexible and adjusts to the needs of those around him even if those needs conflict with his own. It is likely that George has a(n) ______ self-schema.

Fill in the blank(s) with the appropriate word(s).

interdependent

You might also like to view...

A group of customers who share information between themselves and the company about their experiences with the product or service is most likely to be known as a:

A) quality circle. B) cohort. C) community. D) focus group.

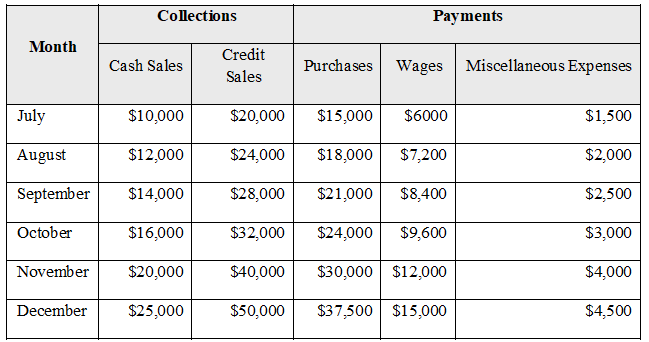

The Right Target, Inc., a marketing research and consulting firm, is working on a cash budget for July to December 2017. The staff has projected the following cash collections and payments:

a) If the ending cash balance as of June 30, 2017 was $10,000, determine the firm’s forecasted monthly cash balance.

b) The staff at The Right Target, Inc. wants to know how much they would need to borrow each month if the minimum ending cash balance is $30,000 and the annual interest rate is 7%.

c) Determine the impact on the ending cash balance if the firm uses any cash surplus above the required minimum cash balance to pay off its short-term borrowing monthly.

Cost behavior analysis is not useful to a service business

Indicate whether the statement is true or false

Write the risk factor constraint

An investor has $80,000 to invest in three stocks, stock A costs $100, stock B costs $120 and stock C costs $80. Each stock A has a risk factor of 8, each stock B has a risk factor of 10 and each stock C has a risk factor of 7. The investor believes that the sum of the risk factors for all stocks purchase should not exceed 6000. The projected annual growth rate for the three stocks are 9%, 13% and 8% respectively. The projected annual dividend income from these stocks are as follows: Stock A: $14/stock, Stock B: $15/stock, and Stock C: $20/stock. The investor desires an annual dividend income of $10,000. The investor has established the following goals in order of their importance: (1) The investor believes that the budget cannot be exceeded. (d1) (2) The risk factor should not exceed the target amount of 6000. (d2) (3) The average annual growth rate in stock prices must be at least 10%. (d3) (4) The investor desires a dividend income of at least $10,000. (d4)