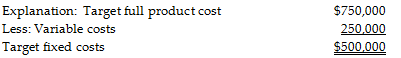

Allen's Ark sells 2100 canoes per year at a sales price of $470 per unit. Allen's sells in a highly competitive market and uses target pricing. The company has calculated its target full product cost at $750,000 per year. Total variable costs are $250,000 per year and cannot be reduced. Assume all products produced are sold. What are the target fixed costs?

A) $987,000

B) $237,000

C) $250,000

D) $500,000

D) $500,000

You might also like to view...

MoJo Corporation purchases goods on credit with terms of 4.5/15, net 40. Which of the following is the annual cost (APR) of the non-free trade credit if the firm pays on Day 40 (i.e., the cost of forgoing the discount)? In your computations, assume there are 360 days in a year.

A. 42.41% B. 67.85% C. 0.00% D. 30.84% E. 113.09%

Nathaniel and Kimberly want to make an offer on a 2,200 square foot home that is priced at $212,000

They research other home prices and find the following information: a 2,400 square foot home sold for $220,000; a 1,800 square foot home sold for $168,000; a 2,000 square foot home sold for $185,000. Based on your analysis, what reasonable offer should Nathaniel and Kimberly make on the house? (Round all computations to the nearest dollar.) A) $212,000 B) $200,400 C) $204,600 D) $194,000

A use case summarizes an event and defines one activity

Indicate whether the statement is true or false

Activity-based costing (ABC) can be applied to administrative activities (e.g., purchasing) but not to marketing activities.

Answer the following statement true (T) or false (F)