Consider that Britain is trying to maintain a fixed exchange rate with respect to the U.S. dollar. However, the present situation in the foreign exchange market is conducive for the British pound to depreciate with respect to the U.S. dollar. If the British government uses sterilized intervention in the foreign exchange market, then

A. Britain will be running an overall payments surplus.

B. the British monetary authorities will be selling British government bonds.

C. Britain is gaining official international reserves.

D. the British monetary authorities will be buying British government bonds.

Answer: D

You might also like to view...

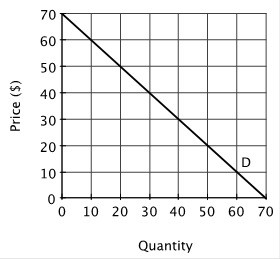

Suppose a monopolist faces the demand curve shown below.  If you were to draw the monopolist's marginal revenue curve, it would:

If you were to draw the monopolist's marginal revenue curve, it would:

A. intersect the horizontal axis at 35. B. intersect the vertical axis at $35. C. lie on top of the demand curve. D. have a slope equal to the reciprocal of the slope of the demand curve.

The “free rider” problem occurs when a good is

A. not available. B. not excludable. C. not depletable. D. not sold in free markets.

An insurance company offering a high-deductible plan is an example of:

A. screening. B. signaling. C. building a reputation. D. statistical discrimination.

If a country went from a government budget deficit to a surplus, national saving would

a. increase, shifting the supply of loanable funds right. b. increase, shifting the supply of loanable funds left. c. decrease, shifting the demand for loanable funds right. d. decrease, shifting the demand for loanable funds left.