Suppose that bank reserves (res) are a function of the nominal interest rate (i): res = 0.3 - 3i.The money multiplier is (cu + 1)/(cu + res), where cu is the currency-deposit ratio. Initially, suppose the real interest rate (r) equals 0.03, the expected inflation rate (pe) equals 0.03, and the currency-deposit ratio equals: cu = 0.4 - (10 × pe).The real money demand function is L(Y,i) = 0.8Y - 1500i, where Y is the level of output. The monetary base equals 100. The price level equals 1.0 initially and will not change in the short run, but will adjust in the long run.(a)Calculate the currency-deposit ratio, the reserve-deposit ratio, the money multiplier, the money supply, and the equilibrium level of output. Assume that this level of output equals full-employment output, so

you are assuming that the economy is in general equilibrium with the price level equal to 1.0. Show your work.(b)Suppose financial innovation causes the reserve-deposit ratio to decline to res = 0.2 - 3i. Calculate the new currency-deposit ratio, the reserve-deposit ratio, the money multiplier, the money supply, and the equilibrium level of output in the short run, assuming a Keynesian model with the price level fixed in the short run. Show your work.(c)Calculate the equilibrium price level in the long run. Show your work.

What will be an ideal response?

| (a) | cu = 0.4 - (10 × 0.03) = 0.1; res = 0.3 - (3 × 0.06) = 0.12; mm = (cu + 1)/(cu + res) = (0.1 + 1)/(0.1 + |

MS = mm × BASE = 5 × 100 = 500; MD = P × [0.8Y - 1500i] = 0.8Y - (1500 × 0.06) = 0.8Y - 90.

Setting MS = MD gives 500 = 0.8Y - 90, so 0.8 Y = 590, so Y = 737.5.

| (b) | res = 0.2 - (3 × 0.06) = 0.02; mm = (cu + 1)/(cu + res) = (0.1 + 1)/(0.1 + 0.02) = 1.1/0.12 = 9.167; |

| (c) | In the long run, Y = 737.5, so 916.7 = P × [(0.8 × 737.5) - 90], so P = 1.8334. |

You might also like to view...

Which of the following increases money demand?

A) Disruptions in the banking system. B) The introduction of online banking. C) The wider availability of ATMs. D) The introduction of deposit insurance.

If the absolute value of the price elasticity of demand for tickets to a football game is 2, then if the price increases by 1%, quantity demanded decreases by:

A. 1%. B. 4%. C. ½%. D. 2%.

Which of the following is similar for both a competitive industry and a monopoly?

A.) The level of economic profits in the long run. B.) Continuous pressure to improve product quality. C.) Profits signal consumers' demand for more output. D.) In the long run, average total costs are minimized.

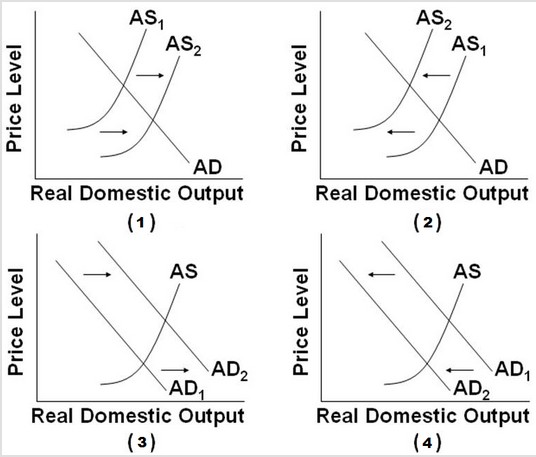

Use the following diagrams for the U.S. economy to answer the next question. Assuming the economy is initially at full employment, which of the diagrams best portrays a recession?

Assuming the economy is initially at full employment, which of the diagrams best portrays a recession?

A. Graphs (1) and (2) B. Graphs (1) and (3) C. Graphs (2) and (4) D. Graphs (3) and (4)