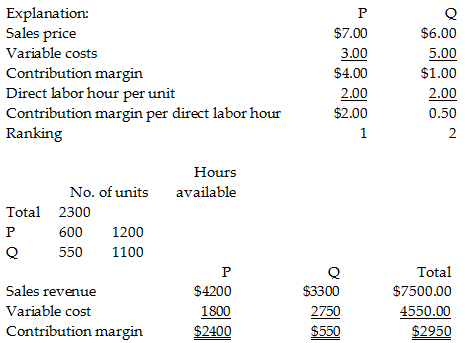

Hadlee Corporation produces two products, P and Q. P sells for $7.00 per unit; Q sells for $6.00 per unit. Variable costs for P and Q are $3.00 and $5.00, respectively. There are 2300 direct labor hours per month available for producing the two products. Product P requires 2.00 direct labor hours per unit, and product Q requires 2.00 direct labor hours per unit. The company can sell up to 600 units of each kind per month. What is the maximum monthly contribution margin that Hadlee can generate under the circumstances? (Round to nearest whole dollar.)

A) $2400

B) $550

C) $2950

D) $12,050

C) $2950

You might also like to view...

A senior vice president is an example of what level of manager?

A. first-line B. top C. leadership D. middle E. merit

Conversion costs are defined as the combined total of direct materials costs and direct labor costs incurred by a production department

Indicate whether the statement is true or false

Opal Manufacturing Company established the following standard price and cost information: Sales price$50per unitVariable manufacturing cost 32per unitFixed manufacturing cost$100,000totalFixed selling and administrative cost$40,000total Opal expected to produce and sell 25,000 units. Actual production and sales amounted to 26,500 units.Required:(a) Determine the sales volume variances, including variances for number of units, sales revenue, variable manufacturing cost, fixed manufacturing cost, and fixed selling and administrative cost. (b) Classify the variances as favorable (F) or unfavorable (U). (c) Comment on the usefulness of the variances with respect to performance evaluation. (d) Explain why the fixed cost variances are zero.

What will be an ideal response?

Three different tests are used by the Supreme Court as standards in reviewing cases which raise issues of equal protection. What are the three tests? When is each applied? In your opinion, why have different tests been developed?