Traditional monetarists advocate for a rule for _____________ , while market monetarists argue that monetary policy should focus on a ______________________

A) nominal GDP target; money supply growth

B) Real GDP target; nominal GDP target

C) money supply growth; Real GDP target

D) money supply growth; nominal GDP target

D

You might also like to view...

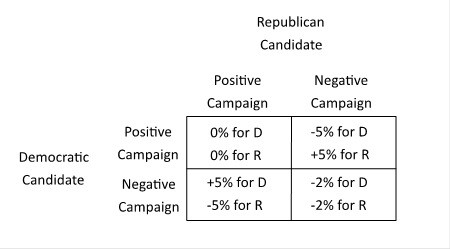

The table below shows how the payoffs to two political candidates depend on whether the candidates run a positive or negative campaign. The payoffs are given in terms of the percentage change in the number of votes received.  In the Nash equilibrium of this game:

In the Nash equilibrium of this game:

A. both candidates run negative campaigns. B. one candidate runs a positive campaign, and the other runs a negative campaign. C. as long as one party runs a positive campaign, the other does too. D. both candidates run positive campaigns.

If the central bank does not purchase foreign assets when output increases but instead holds the money stock constant, can it still keep the exchange rate fixed at ? Please explain with the aid of a figure

What will be an ideal response?

Countercyclical fiscal policy refers to

a. any fiscal policy that cycles between budget surpluses and budget deficits b. the use of taxes and government spending to keep the economy close to potential GDP in the short run c. any fiscal policy that is employed during a business cycle d. the use of open market purchases of bonds to keep the economy close to potential GDP in the short run e. the use of changes in tax rates to keep the economy at potential output in the long run

The United States could begin building a new type of flat-panel, three-dimensional television (FP3D). However, Japanese firms have been producing such televisions for a couple of years and are already low-cost, high-quality producers. Should the United States impose temporary protection in the form of a tariff on this product to protect the domestic industry until it is mature enough to compete with the Japanese producers? Why or why not?

What will be an ideal response?