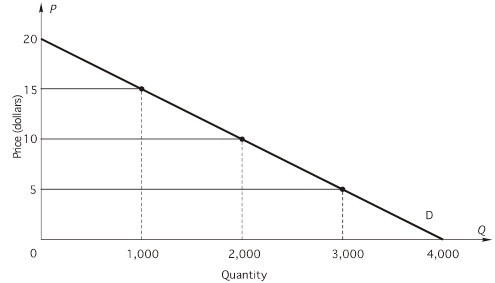

Refer to the following figure. When quantity demanded is 2,000, what is marginal revenue?

A. 0

B. $10

C. $15

D. -$10

E. $12

Answer: A

You might also like to view...

A movement along a demand curve is most likely to be caused by

A) a change in the population. B) a change in expectations. C) a change in income. D) a change in the price of a good.

Which of the following are possible justifications for government redistribution of income?

a. The desire for a more unequal distribution of income. b. Charity is a collective consumption good and thus might be underprovided. c. Redistribution acts as insurance against further coercion. d. Private redistribution of income merely shuffles money around the rich and upper-middle class.

A regressive tax structure is one: a. in which the tax rate increases as the base increases

b. in which the tax rate remains the same as the base increases. c. that tends to discourage additional work as income rises. d. that is famous and in use in the U.S. e. in which the tax rate increases as the base increases.

In the short run, fiscal and monetary policy cause unemployment and inflation to move in opposite directions because

a. the Fed and Congress rarely agree on policy. b. one controls aggregate demand, the other controls aggregate supply. c. both policies control only aggregate supply. d. both policies control only aggregate demand.