Prinkle Corporation purchased equipment for $60,000 on January 1, 2016. On December 31, 2018, the equipment was sold for $28,000. Accumulated Depreciation as of December 31, 2018 was $31,000

Calculate gain or loss on the sale.

A) $1,000 gain

B) $1,000 loss

C) $31,000 loss

D) no gain no loss

B .Loss on disposal = Book value - Market value of assets received = (60,000 - 31,000 ) - $28,000 = $1,000

You might also like to view...

Because hard feelings about group leadership and assignments have passed, the members of Robin's group now seem to be relating much better. At the meeting tomorrow, she should take advantage of this moment by

A. encouraging members to voice disagreements. B. helping the team identify group goals and values. C. helping people get to know one another. D. empowering the members. E. throwing a thank-you party.

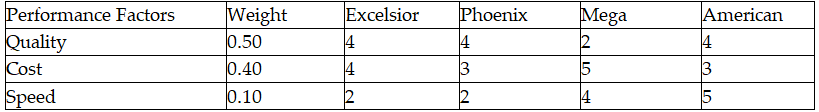

The table below contains a list of four companies that have been rated (on a 1 to 5 scale) on three weighted performance factors. What is the score for Phoenix?

A) 2.5

B) 3.4

C) 3.9

D) 4.1

On July 1, Alexandra contributes business equipment (which she had purchased two years ago) having a $45,000 FMV and a $40,000 adjusted basis to the AX Partnership in exchange for a 25% interest in the capital and profits. The basis of Alexandra's partnership interest is

A) $5,000. B) $40,000. C) $45,000. D) None of the above.

What is a masquerading attack that combines spam with spoofing?

A. Phishing expedition B. Phishing C. Spear phishing D. Pharming