First Safety, a commercial bank, has $6,000,000 of outstanding demand deposits and actual reserves of $1,700,000 . If the reserve ratio is 25 percent, what is the maximum amount of new loans the bank can extend?

a. $100,000

b. $425,000

c. $200,000

d. $1,500,000

c

You might also like to view...

The long-run aggregate supply curve assumes that

A) the unemployment rate is more than 9 percent. B) there is no government purchasing of goods and services. C) only laborers are fully employed. D) all factors of production are fully employed.

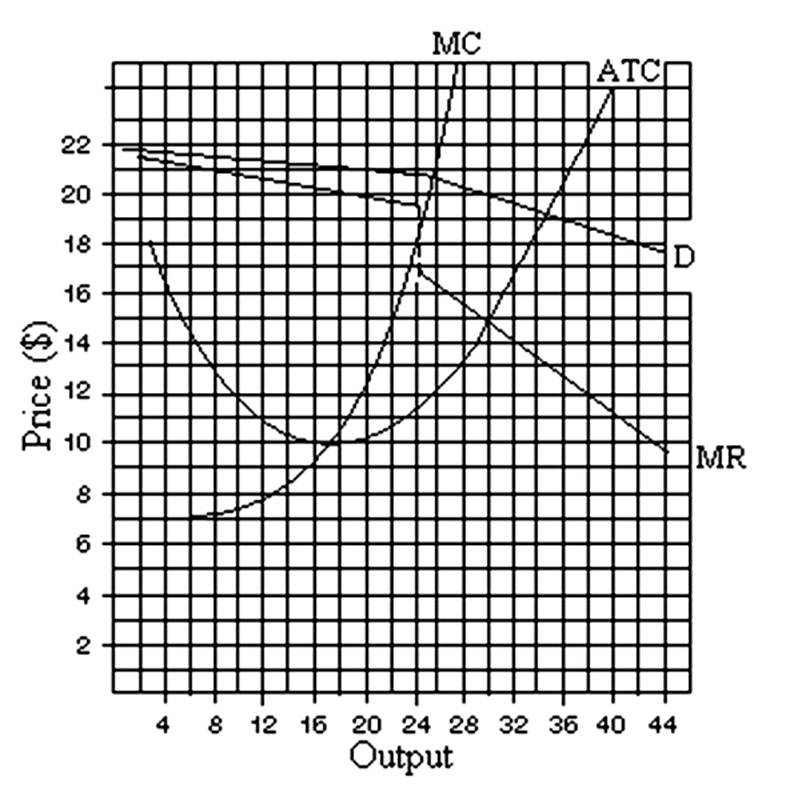

Calculate the firm's total profit.

When negative externalities exist, a voluntary agreement can be negotiated. Which of the following statements is TRUE?

A) Voluntary agreements usually do not work since the owner has no incentive to negotiate. B) Transactions costs must be low relative to the expected benefits of reaching an agreement. C) Voluntary agreements are difficult to negotiate because they usually involve government intervention. D) Voluntary agreements always leave the owner worse off.

The basic purpose of imposing legal reserve requirements on commercial banks is to:

A. Assure the liquidity of commercial banks B. Provide a device through which the credit-creating activities of banks can be controlled C. Provide a proper ratio between earning and no earning bank assets D. Provide the central banks with necessary working capital