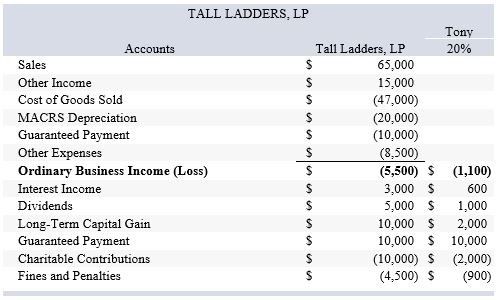

At the end of Year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For Year 2, Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership. Given the following income statement and balance sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of Year 2?TALL LADDERS, LPIncome StatementYear 2Sales$65,000 COGS$(47,000)Gross Profit$18,000 Interest Income$3,000 Dividends$5,000 Long-Term Capital Gain$10,000 Other Income$15,000 Total Other Income$33,000 MACRS Depreciation$(20,000)Guaranteed Payments$(10,000)Charitable Contribution$(10,000)Fines and Penalties$(4,500)Other Expenses$(8,500)Total Other Expenses$(53,000)Net Income (Loss)$(2,000)TALL

LADDERS, LPBalance Sheet Year 1Year 2Assets$120,000$270,000Nonrecourse Liabilities$50,000$180,000Partner's Capital$70,000$90,000

What will be an ideal response?

Tony's adjusted basis at the end of Year 2 is $65,600. The required computations are reflected in the tables below:

| TONY'S OUTSIDE BASIS | |||

| Tony | |||

| Initial Tax Basis | $ | 40,000 | |

| Deemed Cash Contribution from Debt Increase | $ | 26,000 | |

| Interest Income | $ | 600 | |

| Dividends | $ | 1,000 | |

| LTCG | $ | 2,000 | |

| Fines and Penalties | $ | (900 | ) |

| Ordinary Business Loss | $ | (1,100 | ) |

| Charitable Contributions | $ | (2,000 | ) |

| Adjusted Tax Basis | $ | 65,600 | * |

| ? | |||

You might also like to view...

Your current assignment at York Foods is to find the major benefits people look for in the packaged goods market , the kinds of people who look for each benefit, and the major brands that deliver each benefit

Your assignment involves an analysis of the ________ element of the marketing mix. A) product B) promotion C) people D) price E) place

In CSR performance, what is often measured is/are ______________.

a. Perceptions rather than actual performance b. Philanthropy rather than actual performance c. Ideals rather than actual performance d. Ideas rather than actual performance

The MBTI measures a person's preference for

A. experience versus intuition. B. introversion versus extraversion. C. thinking versus acting. D. feeling versus needing. E. judging versus understanding.

A union has negotiated a contract that states the following: work up to 40 hours per week will

be paid at a base rate of $10 per hour. All work in excess of 40 hours, but less than 48 hours will be paid at a rate equal to 1 1 2 times the base rate. Any work in excess of 48 hours will be paid at double time. This pay scale agrees with A) ceteris paribus. B) the law of demand. C) the law of supply. D) the law of supply and demand. E) can't tell with the information provided.