Starbucks posting the latest music, or explaining how to grow coffee beans is an example of _______________ in the social media world.

a. Creating awareness

b. Adding value

c. Selling

d. Word of mouth

b. Adding value

You might also like to view...

For speakers to be consistently efficient at verbally conveying their intended meanings, they must

a. understand that intended meanings may not be fully conveyed by a message because of a variety of factors. b. use shared language that has a universal meaning. c. reiterate their message more than once to the recipient. d. constantly define what their words mean during an communication interaction.

Process innovation ______.

a. is the development and introduction of a brand-new product or service through changes in product design b. is the development and introduction of a brand-new product or service through changes in materials and components used in the product c. refers to the way materials are ordered and delivered to a company d. refers to the changes in the way in which product is produced or a service is delivered within the firm or across a supply chain.

Nicholas Sharp and Barry and Rhonda Downey own adjacent tracts of land in Howard County, Maryland. Their two adjacent lots were a single tract of land owned by Jack Ryan, Inc, the corporate alter ego of John E. Ryan. On February 20, 1996, Ryan divided the tract by deed, creating Lot 1 and Lot 2. Ryan then conveyed Lot 1 to Pamela Jekel. On the same date as the conveyance of Lot 1, Ryan and Jekel

executed an easement instrument which gave Ryan access to his Lot 2 over the existing Jeep trail located on Lot 1. Jack Ryan ended up married to Pamela Jekel and conveyed his lot to Nicholas Sharp. Pamela Jekel Ryan conveyed her lot to Barry and Rhonda Downey. ?The easement was originally a Jeep trail and was described as such in the original Ryan and Jekel documents. When Nicholas Sharp acquired the lot from Jack Ryan, he began constructing a driveway where the Jeep trail was located. The Downeys objected to the expansion of the easement. A) Sharp does not have the right to alter the easement because he does not own the easement. B) Only the servient tenement can make changes in the easement. C) Only the dominant tenement can make changes in the easement. D) None of the above

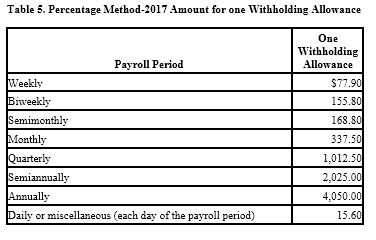

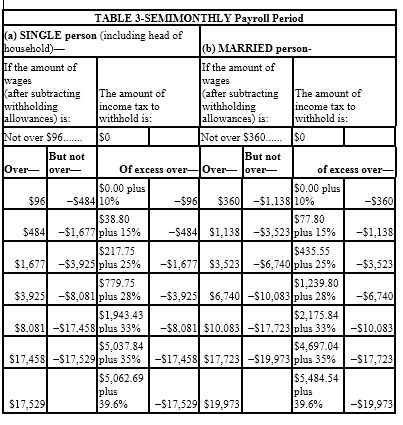

Danny is a full-time exempt employee in Alabama, where the state income tax rate is 5%. He earns $78,650 annually and is paid semimonthly. He is married with four withholding allowances. His is health insurance is $100.00 per pay period and is deducted on a pre-tax basis. Danny contributes 5% of his pay to his 401(k). Assuming that he has no other deductions, what is Danny's net pay for the

period? (Use the percentage method for the federal income tax and the wage-bracket table for the state income tax. Do not round interim calculations, only round final answer to two decimal points.)

A) $2,245.53

B) $2,403.95

C) $2,361.72

D) $2,178.90