What is the deduction for organizational expenses if Green chooses to deduct its costs as soon as possible?

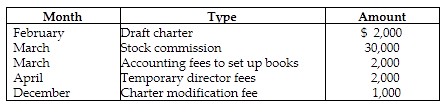

Green Corporation is incorporated on March 1 and begins business on June 1. Green's first tax year ends on October 31, i.e., a short year. Green incurs the following expenses during the year:

A) $36,000

B) $5,028

C) $667

D) $500

B) $5,028

Amortization of organizational expenses does not include the stock commission, which reduces paid-in capital, and the charter modification, which is incurred after the initial year-end

$2,000 + $2,000 + $2,000 = $6,000 - $5,000 = $1,000/180 mo. × 5 mo. = $28

$5,000 + 28 = $5,028

.

You might also like to view...

The value of information for users is determined by all of the following but

a. reliability b. relevance c. convenience d. completeness

Compared to other innovations, firms have been relatively slow to adopt e-commerce.

Answer the following statement true (T) or false (F)

Sheri files a petition for bankruptcy. She must include with the petition

a. a plan to turn over her future income to a trustee. b. a certificate proving credit-counseling from an approved agency. c. a provision of adequate means to make periodic cash payments to creditors. d. a statement of preference for one creditor over another.

What is the decision criterion for a knapsack problem?

What will be an ideal response?