If Congress authorized the President to lower tax rates or to initiate spending projects when aggregate demand was inadequate, which consequence could be predicted most confidently?

A) Aggregate spending would be more stable over time.

B) Recessions would be less severe.

C) Recessions would occur less frequently.

D) The political power of the President would increase.

E) We would experience a lower rate of inflation.

D

You might also like to view...

Assume that a very unusual production process involves increasing marginal productivity that appears to have no end. What would the total productivity function look like? Comment on the likelihood of such a function in the real world

What will be an ideal response?

Consider a large open economy that has a positive current account balance. (a) Suppose the domestic government increases the tax rate on firm revenues

Draw a diagram to explain the effects on the world real interest rate, saving in each country, investment in each country, and the current account balance in each country in equilibrium. Explain your work. (b) In addition to the tax increase in part (a), suppose now that the foreign government increases lump-sum taxes on individuals. Draw a new diagram to incorporate the overall effects of both tax changes and explain the effects (from the initial equilibrium with neither tax change) on the world real interest rate, saving in each country, investment in each country, and the current account balance in both countries. Explain your work.

In a perfectly competitive market

A. demand facing the industry is perfectly elastic. B. a firm must lower price to attract more customers. C. the additional revenue from selling one more unit of output is less than price. D. all of the above E. none of the above

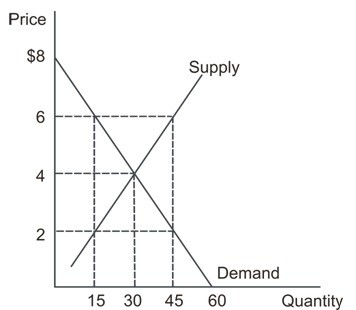

Refer to the graph shown that depicts a third-party payer market for prescription drugs. If the co-payment is $2 per pill, what will be the quantity demanded?

A. 15 B. 30 C. 60 D. 45