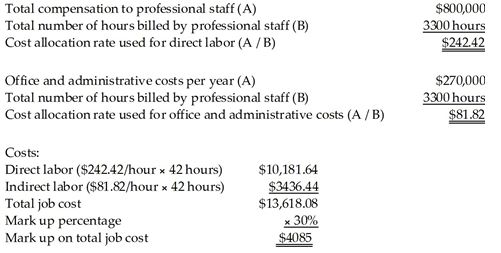

Brink Financial Advisors provides accounting and finance assistance to customers in the retail business. Brink has four professionals on staff, plus an office with six clerical staff. Total compensation, including benefits, for the professional staff runs up to $800,000 per year, and normal billable hours are about 3300 billable hours per year. The professional staff keep detailed time sheets organized by client number. The total office and administrative costs for the year are $270,000. Brink allocates office and administrative costs to clients monthly, using a predetermined overhead allocation rate based on billable hours. During July, Brink's professionals spent 42 hours on their client, Waseca Sales. Brink adds a 30% markup on its costs to calculate the amount billed to the customer. H

A) $13,618.08

B) $3054.492

C) $3436

D) $4085

D) $4085

Explanation: Gross profit is the mark-up charged on costs incurred.

You might also like to view...

Your bank account pays a 5% nominal rate of interest. The interest is compounded quarterly. Which of the following statements is CORRECT?

A. The periodic rate of interest is 5% and the effective rate of interest is also 5%. B. The periodic rate of interest is 1.25% and the effective rate of interest is 2.5%. C. The periodic rate of interest is 5% and the effective rate of interest is greater than 5%. D. The periodic rate of interest is 1.25% and the effective rate of interest is greater than 5%. E. The periodic rate of interest is 2.5% and the effective rate of interest is 5%.

What requirements must be met if a shareholder meeting is to be conducted remotely?

What will be an ideal response?

A disruptive innovation is a product or service that ______.

A. takes root initially in simple applications B. takes root typically at the high end of a market C. is usually high priced D. is mandated by the government

The more variable the firm's cash flows from operating activities, the more risk that the firm will not have sufficient cash to meet the required payments. Failure to meet these obligations can result in

a. default. b. creditor intervention in the management of the firm. c. regulatory intervention in the management of the firm. d. bankruptcy. e. All of these answer choices are correct.